29+ How much mortgage can we have

Compare Mortgage Options Get Quotes. You should have three.

Volunteer Thank You Letter Check More At Https Nationalgriefawarenessday Com 25147 Volunteer Thank You Letter

If I pay 800 per month how much of a mortgage loan will that be.

. Common mortgage terms are 30-year or 15-year. This ratio says that. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Longer terms usually have higher rates but lower. 6 hours agoThis week the average interest rate on a 10-year HELOC is 616 downa bit from 617 the previous week and 620 the high over the past year. A mortgage loan term is the maximum length of time you have to repay the loan.

Enter the monthly payment the interest rate and the loan length in years. Compare Mortgage Options Get Quotes. You have a credit score of 720.

As part of an. Get Instantly Matched With Your Ideal Home Loan Lender. But our chase home affordability.

Your debt-to-income ratio DTI should be 36 or less. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. There are a lot of factors that go into how many mortgages you can have.

You have six months worth of reserves for. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. The maximum amount you can borrow with an FHA-insured.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Find Out If You Qualify Now. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Ad Find The Best Place To Get a Home Loan Today By Comparing The Best Lenders Out There. Your housing expenses should be 29 or less.

A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Ultimately your maximum mortgage eligibility. Using a 45 percent interest rate and a 30-year term this.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross. At the current interest rate a. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

This is for things like insurance taxes maintenance and repairs. For this number of rental properties the bank will finance your real estate investments if. But ultimately its down to the individual lender to decide.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. It is a loan and you must be 62. Get Started Now With Rocket Mortgage.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Were not including any expenses in estimating the income you. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000.

Ad Top Home Loans. See the results for Free refinance calculator mortgage in Suffolk. If your interest rate was.

Get Started Now With Rocket Mortgage. The calculator will tell you how much the loan. The most important one is your credit score.

Compare Find The Lowest Rate. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. What More Could You Need.

If you have a good credit score then you will likely be. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. What More Could You Need.

Ad Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. So to buy the average UK house costing 250000 youd normally need at least a 25000 deposit to borrow the 225000 required to buy the house. To start youll need a good grasp of your finances specifically the total income youre bringing in each month and the monthly payments for any debts you owe student loans.

Exquisite Kitchen Kitchens By Design Indianapolis Www Mykbdhome Com Granite Hardwoodfloors Home Decor Kitchen Kitchen Design Home Kitchens

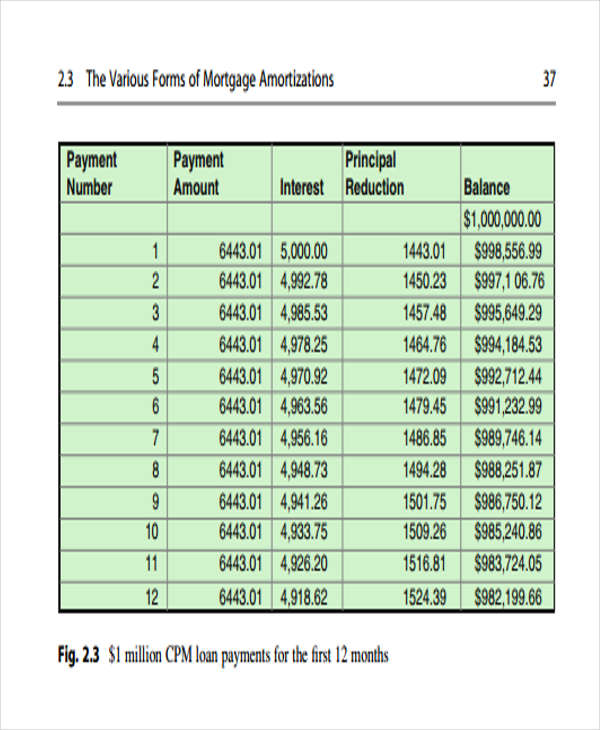

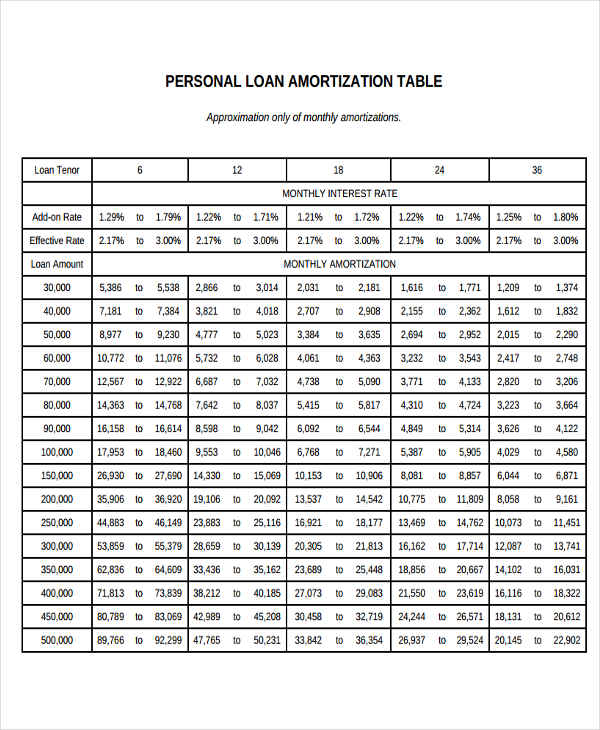

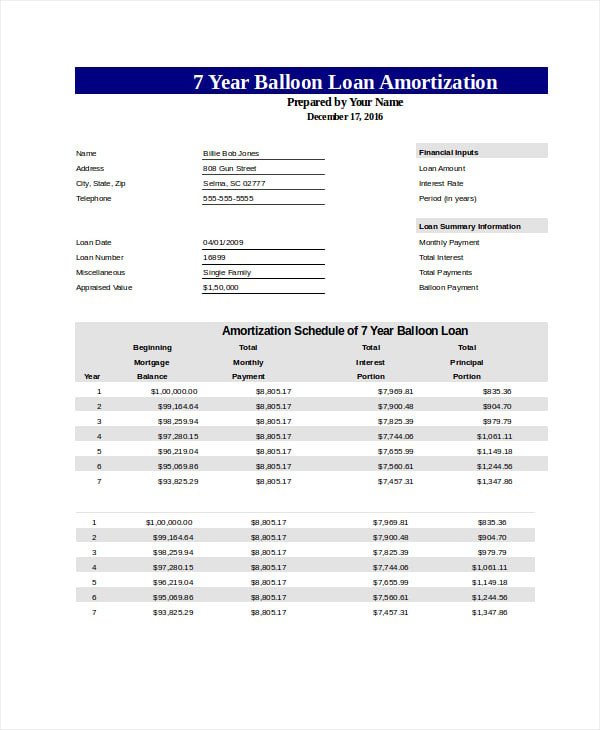

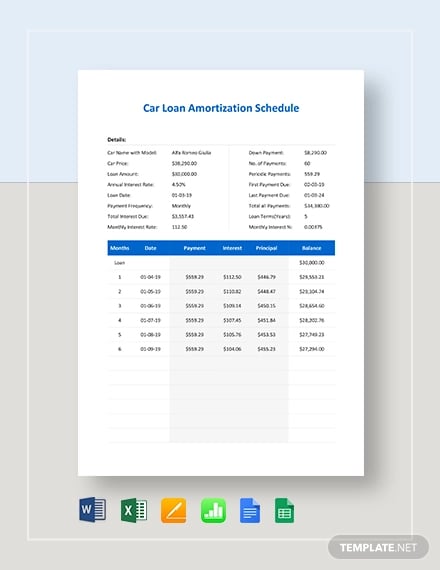

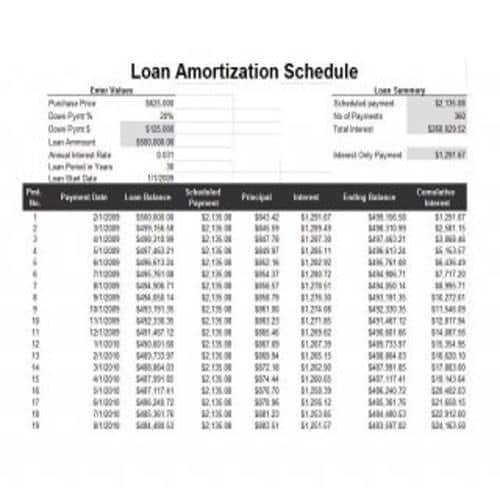

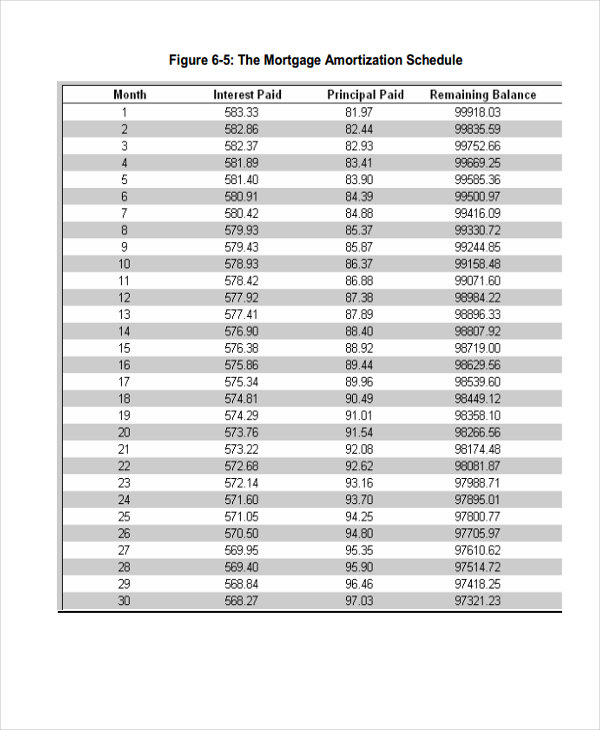

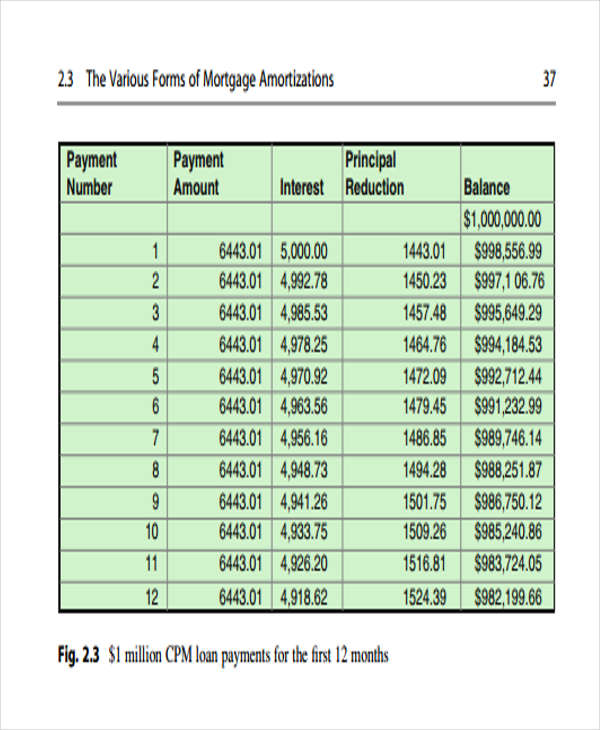

29 Amortization Schedule Templates Free Premium Templates

Free 25 Sample Community Service Letter Templates In Pdf Within Reference Letter Template F In 2022 Community Service Hours Letter Templates Reference Letter Template

29 Editable Loan Amortization Schedule Templates Besty Templates

Amortization Schedule Template 10 Free Sample Example Format Download Free Premium Templates

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Easy Christmas Savings Plan Free Printable Casa Mochi Christmas Savings Plan Christmas Savings Christmas On A Budget

Get Our Image Of Job Offer Letter For Mortgage Template In 2022 Letter Templates Lettering Payoff Letter

Editorial Cover Letter Cover Letter Template Cover Letter Example Templates Writing A Cover Letter

29 Amortization Schedule Templates Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

29 Amortization Schedule Templates Free Premium Templates

Constructive Dismissal Resignation Letter Template Resignation Letter Sample Letter Templates Resignation Letter

29 Editable Loan Amortization Schedule Templates Besty Templates

29 Amortization Schedule Templates Free Premium Templates

Pin On Presentations

Fundraiser Donation Request Letter Pta Fundraising Fundraising Letter Donation Request Letters